Cloud technologies form the foundation of nearly all digital innovation. In light of this, cloud-based business innovation should be seen as the ultimate enabler of successful digital business strategies, but business innovation can only be successful if balanced against spending.

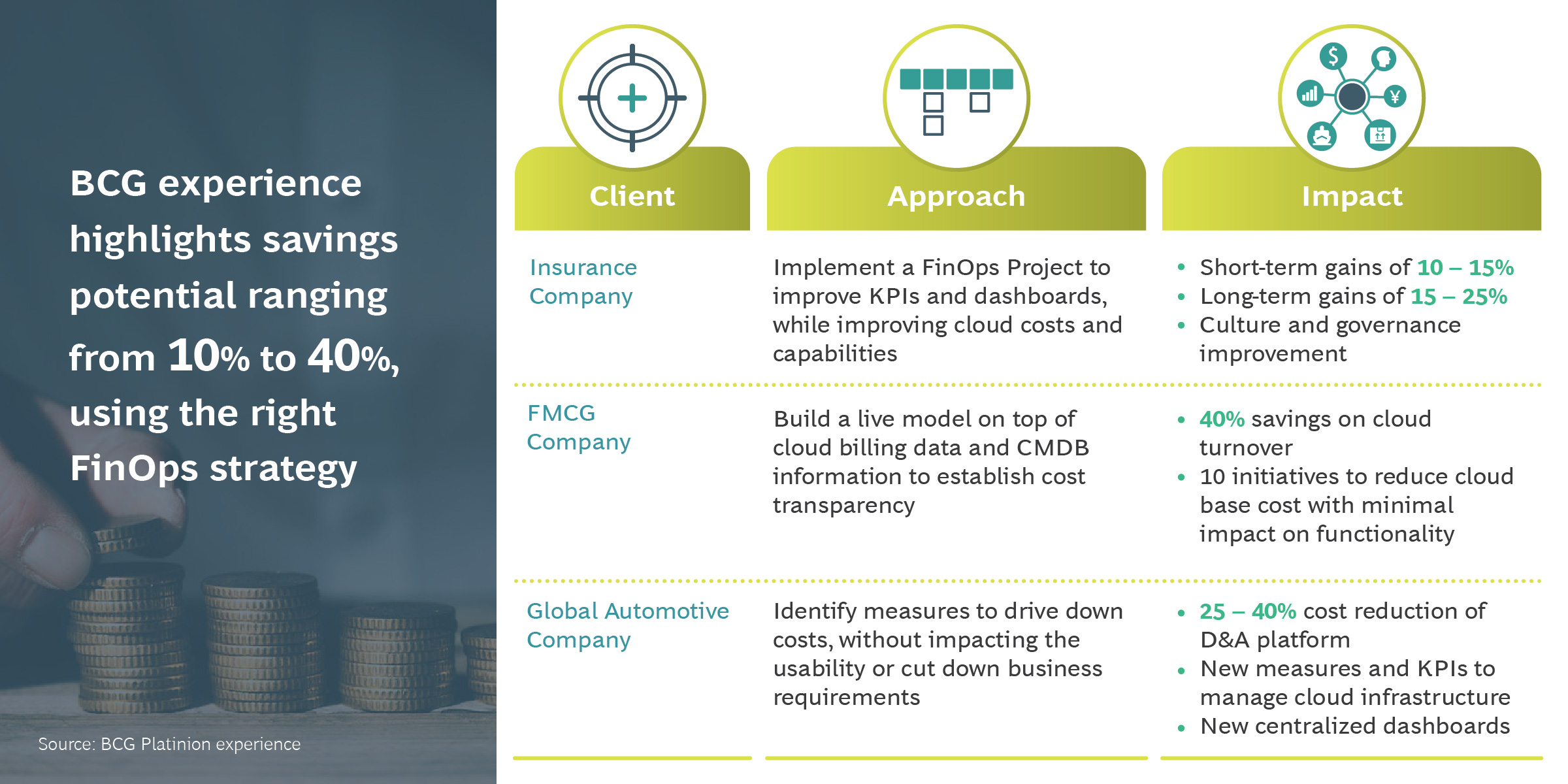

With cloud costs now soaring, how CXOs respond to this spending governance challenge is a key determinant of their organization’s digital transformation initiatives. FinOps provides the necessary governance best practices to establish a solid foundation for cloud growth, and to guarantee success in the digital era. BCG experience highlights savings potential ranging from 10% to 40%, using the right FinOps strategy. Taking the right approach will enable CXOs to navigate both the short and long-term.

Understanding the economics of the cloud

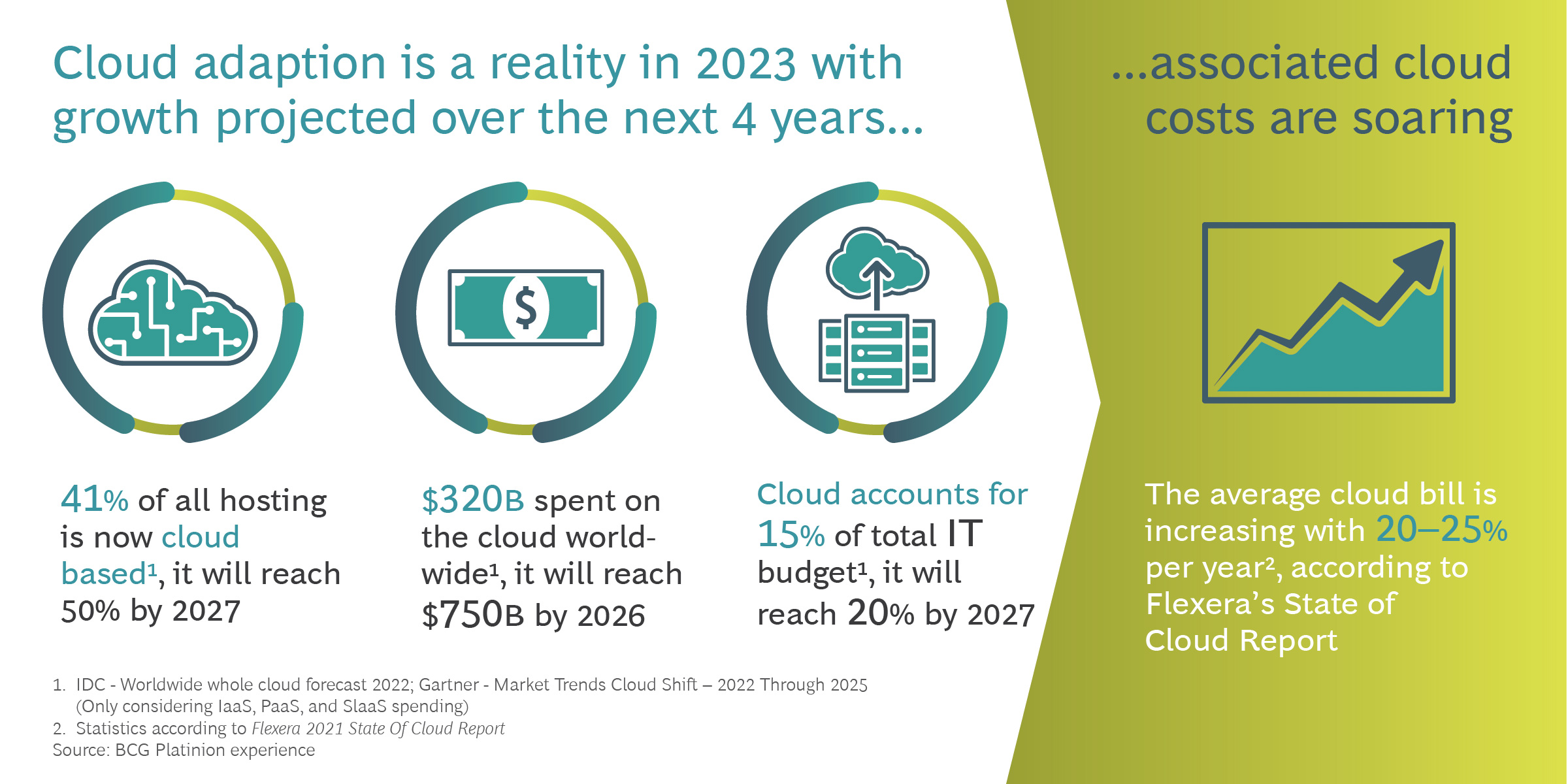

Cloud adoption is a reality in 2023 with significant growth projected over the next four years. We now see that 41% of all hosting is now cloud based, and this will climb to 50% by as soon as 2027. Providing further perspective, $320B has already been spent on the cloud worldwide, which will more than double to reach $750B by 2026.

Cloud represents 15% of total IT budget, and it may account for as much as 20% by 2026. In the meantime, associated cloud costs are soaring. The average cloud bill is increasing by 20 to 25% per year2 according to Flexera’s State of Cloud Report.

With the economic context of cloud adoption in mind, the next critical step is to explore FinOps as a means of achieving cloud cost optimization. From enhanced visibility and control, to greater efficiency, resiliency and time-to-market, the benefits of cloud FinOps are extensive. The successful deployment of FinOps will require a series of correct steps to be taken in the short, medium, and long-term.

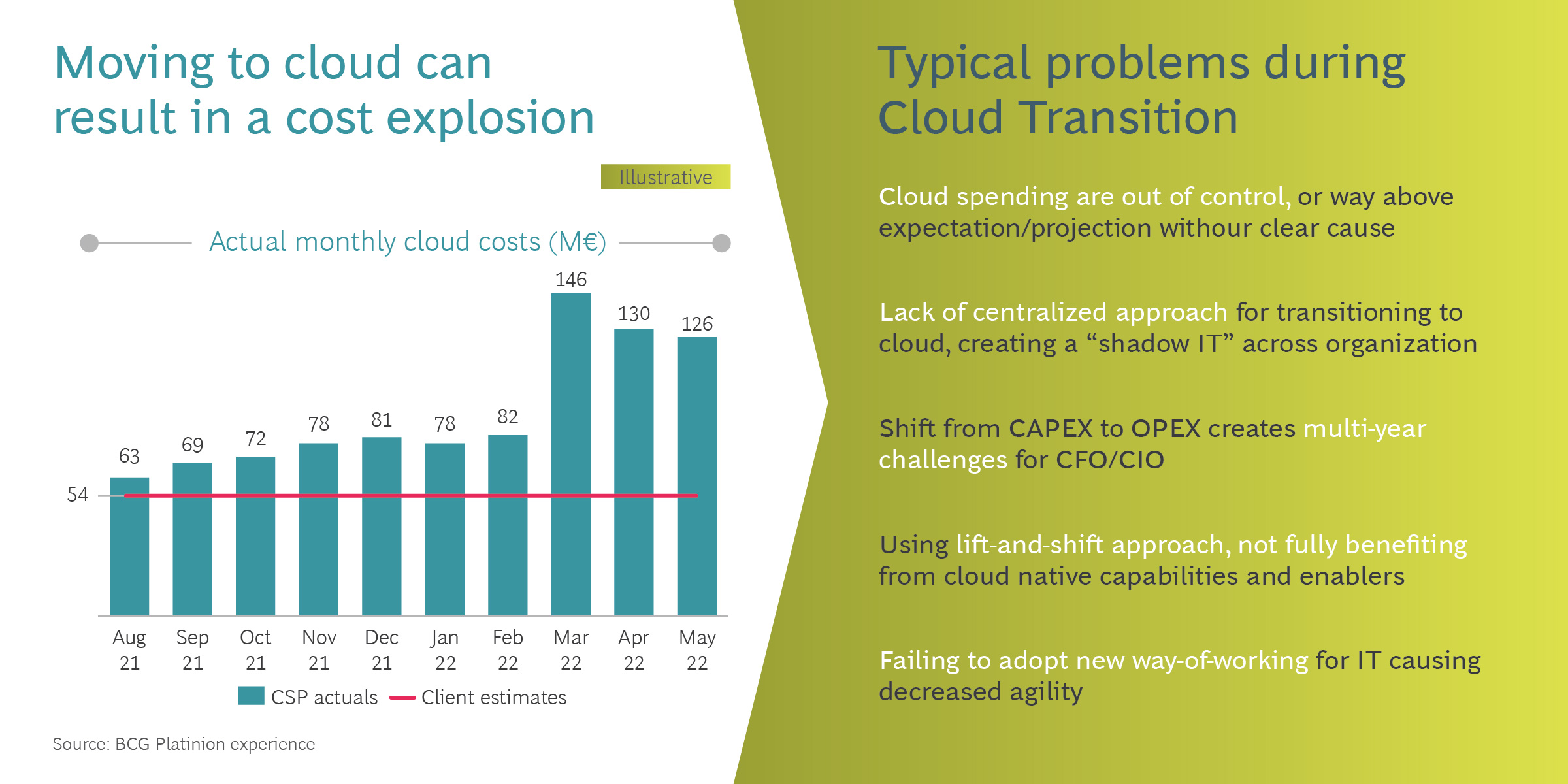

Moving to the cloud can come with a set of challenges. When conducted without the right approach, organizations often experience unsustainable costs associated with the transition, and fragmentation that results in ‘shadow IT.’ Problems can also arise when new ways-of-working are not correctly adopted, causing reduced agility that delays the anticipated benefits.

Cloud FinOps 101

Cloud FinOps is a discipline that emphasizes the importance of measuring and controlling cloud resources to manage costs and drive value effectively. The key idea is that we can only control what we measure. However, in cloud cost management there is often a disconnect between measuring cloud resources costs and the actual value of the apps using these resources.

To bridge this gap, Cloud FinOps relies on implementing rules, guardrails, and governance mechanisms to ensure organizations have a clear framework to optimize costs, maximize value, and maintain control over their cloud environments. At a high level, FinOps consists of three key phases.

The first is to create visibility and transparency when it comes to cloud costs, which means allocating cloud costs to specific teams and projects. Providing easy access to this data is also an important part of this, which is typically achieved through the use of dashboards. Shared accountability is the result of this, with teams required to justify what they are spending and why.

Secondly, the information unlocked through increased visibility should be used to optimize spending. The idea is to leverage the insights you gain to apply cost-saving levers, such as rightsizing, storage tiering, and discounts.

Finally, you need to embed your FinOps practices throughout the organization, ensuring that they become part of your governance and overall operating model. Cloud FinOps is a continuous process, and with each cycle you refine your cloud spending, syncing it to business needs and strategic priorities.

Winning Considerations

FinOps and culture

Culture is a critical aspect of FinOps that is often overlooked or not addressed properly. Instilling this as part of your organizational culture is of paramount importance, particularly within engineering teams. The main purpose for doubling down on FinOps culture is to drive a strong sense of accountability, as well as ensuring the right structure to monitor accountability is in place.

Operational alignment

Building on the notion of cultural cohesiveness when it comes to FinOps, aligning business functions, finance, procurement, and IT teams to work on cloud cost optimization strategy is essential. Due to outdated, siloed operations, this important step often proves to be a barrier to achieving effective FinOps for many organizations. This step is also important when it comes to finding the right balance between organizational enablement and cost control, with innovation and self-service having important roles to play.

Bursting the initial cost bubble

The initial cost bubble that is generated by transitioning to the cloud also causes many businesses to start on the back foot when it comes to optimizing value. Shifting from CAPEX to OPEX is vital here, as is enhancing the accuracy of cloud spend forecasts and multi-cloud cost reporting.

Tactics and talent

Businesses ultimately need to take a comprehensive, strategic approach to FinOps, from identifying the right strategies, to understanding how many people need to be involved in the process. Having access to the correct types of skills, the appropriate visibility of cloud costs, and the ability to communicate the data are also crucial factors to consider at the outset. Underpinning it all must be an appropriate governance framework, with the policies and standards that are necessary to enable rapid cost variation response model.

Learnings to leverage

Most organizations fall short by only being reactive, such as using FinOps as a tool to simply get the cloud bill under control. The result of this is the implementation of solely short-term FinOps levers, as opposed to the long-term benefits unlocked by a FinOps culture that focuses on maximizing value rather than just reducing costs.

Maintaining the right priorities will also help you to sustain an effective approach to FinOps in the cloud context. This is because many organizations deprioritize FinOps during migration to ensure that the platform is successfully implemented, and the business case is secured. Losing sight of FinOps prevents a strong culture being grown around it and causes departments like IT and procurement to fall out of sync.

An unmissable advantage is also unlocked when there is robust sponsorship from the CFO and CTO, as it accelerates the adoption of the required applications to take FinOps to the next level. To find out more about how to maximize the value you derive from your cloud spend, and how to ensure you implement the best approach to FinOps, get in touch with our expert team.

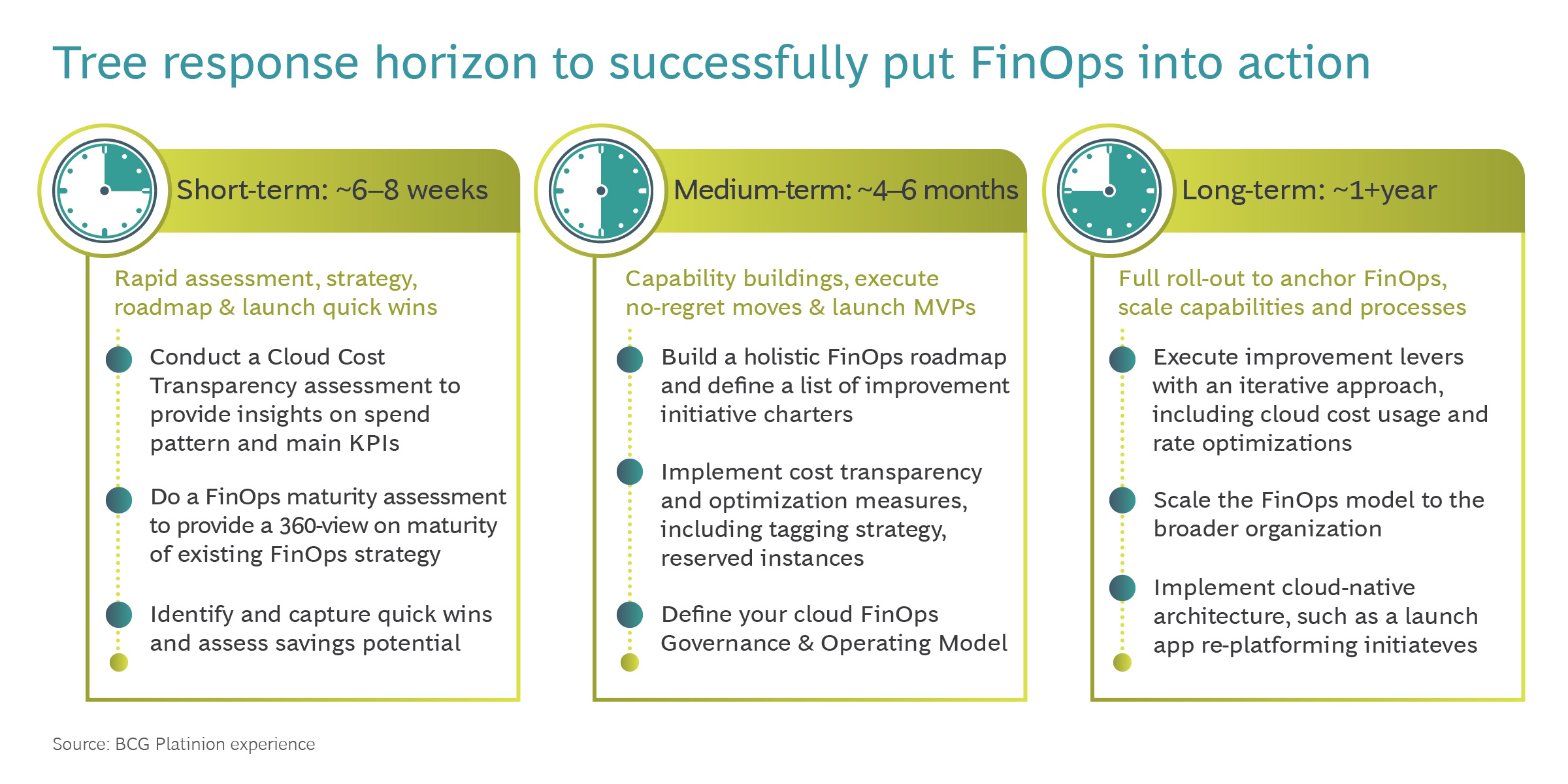

To successfully put cloud FinOps into action, the CXO needs to take actions at the short, medium, and long-term horizons.

Short-term actions (~6-8 weeks):

- Conduct a Cloud Cost Transparency assessment to provide insights on spend patterns and main KPIs, highlighting main usage and costs across teams and departments.

- Do a FinOps maturity assessment to provide a 360-view on maturity of existing FinOps strategy, and implementation across departments and other entities.

- Identify and capture quick wins and assess savings potential. You should also map out opportunities to rapidly reduce costs through quick changes, including rightsizing and the termination of unused resources.

Medium-term actions (~4-6 months):

- Build a holistic FinOps roadmap and define a list of improvement initiative charters to achieve cloud cost efficiency. The goal of this is also to improve FinOps maturity at the organization level in terms of transparency and allocation, cost optimization, and governance & culture.

- Implement cost transparency measures, including a cost allocation model, tagging strategy, billing reports and dashboards.

- Implement advanced cost optimization levers, such as leveraging reserved instances, spot instances, and auto scaling.

- Define your cloud FinOps Governance & Operating Model, including FinOps governance and target operating model (TOM), roles, and responsibilities, FinOps optimal team size, and reporting line.

Long-term actions (~1+ year):

- Execute improvement levers with an iterative approach, including cloud cost usage and rate optimizations. These should span automation, cost anomaly detection, volume or resource reservation, and commitment discounts.

- Scale the FinOps model to the broader organization. This involves providing best practices and guiderails to realign maturity gaps across teams, divisions, and entities.

- Implement cloud native architecture, such as a launch app re-platforming initiative to ensure workloads are cost efficient and optimized for cloud features. Examples of these features include containers, micro-services, and stateless services.

About the Authors

Norbert is Digital Data Platform Leader for EMESA (Europe, Africa, South America) of BCGX. He oversees major Digital Transformation programs to help some of the world’s leading organizations leveraging quality and accessible internal and external data. His transformative mindset has helped clients across a wide range of sectors to build digital advantage toward industry 4.0.