According to the BCG Digital Accelerator Index (DAI), many Private Equity (PE) firms are historically immature when it comes to understanding the opportunities of digital and technology. Because of this, organisations risk missing a golden opportunity while the market is booming. In 2020, PE IT deal activity accounted for a record 25.9% of overall European deal flow, ‘with managers taking more interest in the upside potential of technology’ for their portfolio companies (Pitchbook – 2020 Annual European PE Breakdown). This growth is even more notable in the context of a PE market that rebounded to its third-highest level in a decade, despite the uncertainty created by the COVID-19 pandemic at the start of last year.

Part of this dynamism stems from the growing recognition of technology as a key driver of business value. BCG’s Bionic Company recognises the role of technology in enabling firms to achieve “AI-powered insights, innovate products and design better processes, which drives competitive advantage and top-line growth,” a far cry from the traditional view of tech as a G&A line item on the P&L.

Unfortunately, PE investors at the pre-deal stage of the M&A process too often rely on either traditional commercial and financial-focused due-diligence, or focus their technology due-diligence on backward looking factors.

Whilst the former is a proven and effective approach that directly maps forward-looking company metrics to target valuation (i.e. EBITDA), the value of technology can be missed. Often PEs values tech assets too low and therefore are not able to secure the investment (i.e. win the bid) or are unable to realise the full potential of post-deal value. In the latter instance, focusing only on historic factors such as IT spend and IT architecture complexity limits the field of vision and prevents PEs from capturing the full value of tech in deal making and post-deal value creation.

As a result, we believe a forward looking perspective on tech is required in the due diligence phase. This is valuable both in terms of aligning technology with the support and delivery of core operations, as well as offering a driver for future upside, bottom-line cost savings and top-line revenue growth. In doing so, PEs will benefit from an immediate improvement of their target valuation (including more accurate pre-deal adjustments) and a clearer line of sight on the longer-term value creation path (including required post-deal tech investments).

Examples of forward-looking factors include strong engagement between business and IT teams, mature product & tech operating model, advanced engineering practices & tooling (e.g. DevOps, SRE), effective data strategy & platforms and pro-active cybersecurity capabilities.

It is important to be aware that maximising these benefits is not done without challenge! Our industry experience points to three critical considerations for PE investors when seeking to develop tech-enabled value-creation plans at the pre-deal stage.

Firstly, digital success requires scale and a broad range of digital expertise. Without the scope to ensure that the right technologies can feasibly be implemented, with skilled individuals in place to support their adoption, tech-enabled value is very difficult to create. Secondly, it is important that digital expertise is embedded in the deal team itself, not just on hand. This ensures that an intimate understanding of the technology and its potential is baked in at the pre-deal stage. Finally, once deal teams are equipped with a digital mindset, they need to know how to operationalise their digital plans. This requires both an intimate understanding of the technology and the value it can generate.

Our proven methodology for achieving tech-enabled value

BCG Platinion brings a holistic approach to due diligence, seamlessly incorporating commercial and technology elements from respective experts within their domain. The goal is to maximize investor insight and influence pre-deal valuations

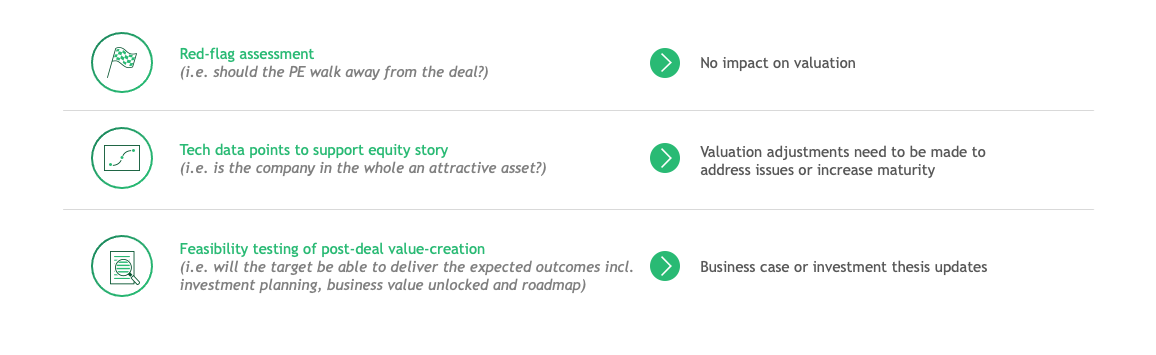

Our work targets three outputs:

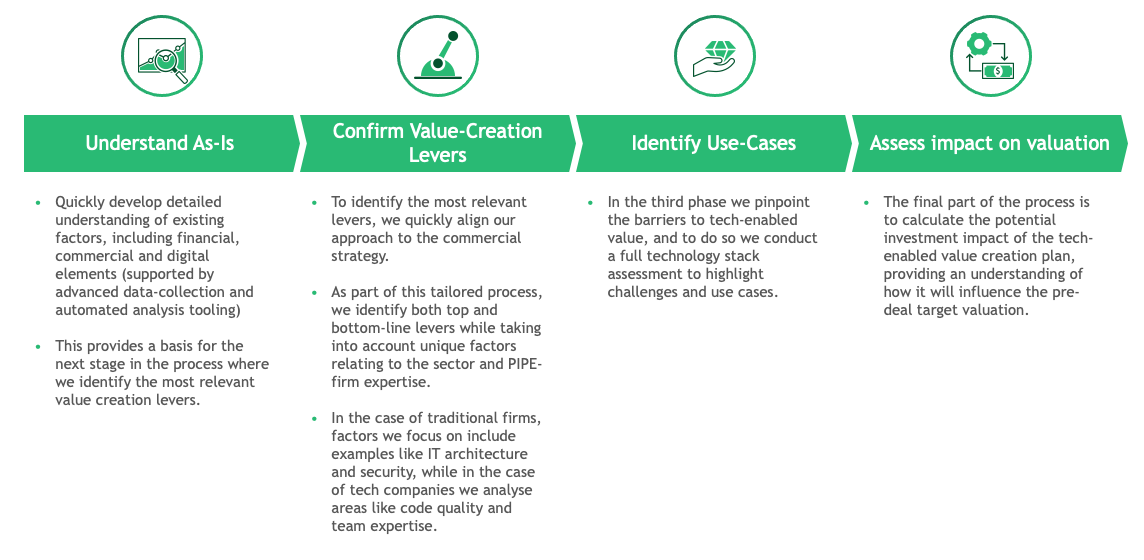

Built on deep sector expertise, advanced technology capabilities and broad organisational knowledge, we deploy a four-step process. This is designed to rapidly gain an understanding of the ‘as-is’, mapping IT value-levers to the deal objectives and target business strategy. Additionally, the process identifies real-world use cases and assesses the overall impact on target valuation.

Delivering impact in PE transactions

We have deployed this approach in hundreds of transactions over the last 5 years including:

Client Story:

Tested the tech feasibility for a PE-owned utilities reseller to venture into adjacent business

Case story: Tested the feasibility of several value creation paths, including leveraging the tech platform to venture into adjacent business areas. By leveraging the tech platform to service customers in both utilities’ products and telecom products, a ~15% contribution to the top-line was enabled, with limited IT investment required.

Impact:

-

Identified additional value creation opportunities based on the assessment of the quality and extensibility of the tech platform:

-

Collected proof points on the tech platform horizontal scalability (more customers) and vertical scalability (additional products)

-

Benchmarked platform functionality against peers (average performers and leaders) in the market

-

Evaluated the technology effectiveness to support existing customer journeys (e.g. customer onboarding) and potential future customer journeys (e.g. product upsell and cross-product billing)

-

-

Tested feasibility to extend the tech platform to unlock the identified top-line growth opportunities

-

Tested the feasibility (investments, duration, roadmap) to extend the technology platform to service customers with additional products

-

Developed an integrated post-deal roadmap to realise the value creation paths

-

~15% contribution to the top-line enabled

Client Story:

Pre-deal IT carve-out design to reduce post-deal IT M&A costs by 40%

Case story: We developed a post-deal tech target-state that would support the investor’s value creation strategy, supporting a roll-up in the market (aggressive M&A strategy). We then developed a pressure-tested view on tech transaction costs and post-deal tech optimisation investment plan.

Impact:

-

Both business upside (~40% costs reduction of future IT M&A costs) and required post-deal investments were factored into the valuation model

-

Developed pressure tested view on investments that would be required to stabilise the company during the transaction (including an IT carve-out)

-

Identified tech investment that the buyer would have to make to facilitate improved efficiencies during later M&A activities. We also developed a target IT architecture, application landscape and target operating model that would support the company to cost-effectively absorb the bolt-on acquisitions that the investor planned during the investment period

-

Developed a business case to justify the post-deal investment and have a clear view on the ROI of the required IT changes

~40% reduction of future IT M&A costs

Client Story:

Pre-deal synergy planning and technology support for global Information services provider using a PE-lens

Case story: Technology due diligence of target, applying a framework to examine factors including product technology, data architecture, cybersecurity, and enterprise IT.

Impact:

-

Produced a defensible synergy plan grounded in future potential based on sector dynamics

-

Challenged and re-baselined existing identified synergies

-

-

Identified future opportunities for incremental synergy potential to set up post-merger integration for success, including:

-

Design choices to unlock the next horizon of value opportunities from automation and product portfolio optimisation

-

New products and solutions leveraging expanded datasets and analytical capabilities, before cross-selling into expanded customer base

-

Enhanced value proposition with complementary products

-

Provided a view on the prioritised markets and areas of overlapping and non-strategic products

-

In summary

We are passionate about the use of technology to accelerate growth, cut costs and improve PE returns. Shifting the focus of technology due-diligence from a backward-focus, to a forward-looking one that targets value creation opportunities will help PE investors to maximise returns. At BCG, we can identify and quantify pre-deal adjustments to ensure target valuations are optimal, and evaluate the future potential of technology. For PE firms only beginning to understand the opportunities of technology, we help to simplify the complex landscape, whilst for those firms with deep expertise, we can sharpen your tools and deliver higher returns.

What makes BCG distinctive

BCG Platinion is a specialised subsidiary at the core of BCG’s digital offering, bringing world class technology due diligence expertise. Our team of over 60 experienced professionals is equipped with unique tech consulting talent, and we have executed numerous high impact tech DDs as part of integrated teams with core BCG commercial elements.

About the Authors

Andreas Rindler

Managing DirectorHead of PIPE

London, UK

Andreas is a Managing Director. He specializes in IT strategy, product & tech transformation and data platforms for global clients in software & technology, media, consumer and financial services industries. He has deep experience working with private equity owned businesses and corporate clients pre-deal or during value creation.

Bartholomew Lambert

PrincipalLondon

Diederik Rothengatter

Associate DirectorLondon

Kasem Asghar

Associate DirectorLondon

Oded Kaplan

Platinion PrincipalLondon